Copyright © 2015 Bert N. Langford (Images may be subject to copyright. Please send feedback)

Welcome to Our Generation USA!

Senior Living

provides activities and programs for those who are retired, including pension plans and other retirement savings and income (including Social Security), health and exercise (through Medicare), senior housing, age-related diseases and other topics.

American Association for Retired Persons (AARP.Org):

YouTube Video: What are the Benefits of being an AARP Member?

Pictured: AARP Magazine, February/March, 2016 Issue.

American Association of Retired Persons (AARP) The AARP was founded in 1958 by a retired teacher, Ethel Percy Andrus, with the goal of helping older Americans remain physically and intellectually active by serving others.

AARP is a nonprofit, nonpartisan, social welfare organization with a membership of nearly 38 million that helps people turn their goals and dreams into real possibilities, strengthens communities and fights for the issues that matter most to families — such as health care, employment and income security, and protection from financial abuse.

Click on the following for Member Benefits

AARP is a nonprofit, nonpartisan, social welfare organization with a membership of nearly 38 million that helps people turn their goals and dreams into real possibilities, strengthens communities and fights for the issues that matter most to families — such as health care, employment and income security, and protection from financial abuse.

Click on the following for Member Benefits

AARP: Best Places to Retire, even Retire to a Good Life for Less

YouTube Video: Best Places to Retire: Deltona/Daytona | AARP

Pictured: The Daytona Boardwalk Amusement Area and Pier offers games and indoor and outdoor rides. — David A. Land.

Whether you're looking for a retirement destination or just seeking new surroundings, our Best Places lists will give you some great ideas. Who knows? You just might find the perfect new place to call home.

Want to retire on $30,000 a year? Or just want to know you could if you had to? We found the 10 most livable, low-cost cities in the U.S. — places where you can retire in comfort no matter how big (or small) your savings account.

Want to retire on $30,000 a year? Or just want to know you could if you had to? We found the 10 most livable, low-cost cities in the U.S. — places where you can retire in comfort no matter how big (or small) your savings account.

U.S. News & World Report: The 10 Best Places to Retire on Social Security Alone

U.S.News and World Report October 14, 2014: "If you don't have a traditional pension through your job and haven't been saving a significant amount in a 401(k) or individual retirement account, Social Security is likely to be your largest source of retirement income. Almost all retirees (86 percent) receive Social Security payments, and for over a third (36 percent) of retirees, Social Security accounts for 90 percent or more of their retirement income. The type of lifestyle Social Security alone will provide largely depends on how much you have earned in Social Security benefits and where you live.

The average Social Security benefit for retired workers was $1,294 per month at the end of 2013. A couple who each brought in this amount would have $31,056 in annual Social Security benefits, which will also be adjusted for inflation each year. U.S. News analyzed Census Bureau and Bureau of Labor Statistics data to determine where a retired couple age 65 or older could cover their basic expenses, including typical costs for housing, food, utilities, transportation and health care, on this amount.

It’s important to note that in most places, Social Security alone barely covered these basic expenses. After paying for those five major costs, retirees living on Social Security alone likely won’t have much cash left over for recreation, hobbies, clothing, consumer goods or travel. “If they are highly dependent on Social Security, it is not an easy life,” says John Palmer, a Syracuse University professor and former public trustee for the Medicare and Social Security programs. “If they own their own home and don’t have high medical expenses, they can probably get by....”

[See: 10 Places to Retire on Social Security Alone.]

For full Article click here.

The average Social Security benefit for retired workers was $1,294 per month at the end of 2013. A couple who each brought in this amount would have $31,056 in annual Social Security benefits, which will also be adjusted for inflation each year. U.S. News analyzed Census Bureau and Bureau of Labor Statistics data to determine where a retired couple age 65 or older could cover their basic expenses, including typical costs for housing, food, utilities, transportation and health care, on this amount.

It’s important to note that in most places, Social Security alone barely covered these basic expenses. After paying for those five major costs, retirees living on Social Security alone likely won’t have much cash left over for recreation, hobbies, clothing, consumer goods or travel. “If they are highly dependent on Social Security, it is not an easy life,” says John Palmer, a Syracuse University professor and former public trustee for the Medicare and Social Security programs. “If they own their own home and don’t have high medical expenses, they can probably get by....”

[See: 10 Places to Retire on Social Security Alone.]

For full Article click here.

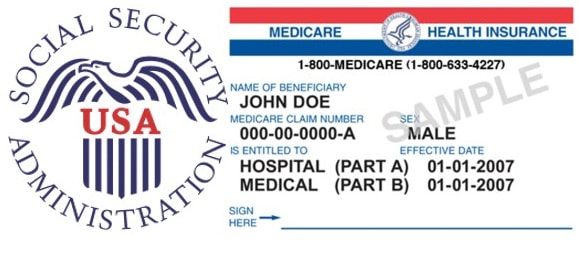

Federal Assistance for Old Age including the Social Security Administration.

YouTube Video about the SSA

About the Social Security Administration:

The United States Social Security Administration (SSA) is an independent agency of the United States federal government that administers Social Security, a social insurance program consisting of retirement, disability, and survivors' benefits. To qualify for most of these benefits, most workers pay Social Security taxes on their earnings; the claimant's benefits are based on the wage earner's contributions. Otherwise benefits such as Supplemental Security Income (SSI) are given based on need.

The Social Security Administration was established by a law codified at 42 U.S.C. § 901.

SSA is headquartered in Woodlawn, Maryland, just to the west of Baltimore, at what is known as Central Office. The agency includes 10 regional offices, 8 processing centers, approximately 1300 field offices, and 37 Teleservice Centers. As of 2007, about 62,000 people were employed by SSA.

Headquarters non-supervisory employees of SSA are represented by American Federation of Government Employees Local 1923. Social Security is the largest social welfare program in the United States. For the year 2014, the net cost of social security was 906.4 billion dollars which accounted for 21% of government expenditure. It has been named the 6th best place to work in the federal government.

The OASDI program—which for most Americans means Social Security—is the largest income-maintenance program in the United States. Based on social insurance principles, the program provides monthly benefits designed to replace, in part, the loss of income due to retirement, disability, or death.

Coverage is nearly universal: About 96% of the jobs in the United States are covered. Workers finance the program through a payroll tax that is levied under the Federal Insurance and Self-Employment Contribution Acts (FICA and SECA). The revenues are deposited in two trust funds (the Federal Old-Age and Survivors Insurance Trust Fund and the Federal Disability Insurance Trust Fund), which pay benefits and the operating expenses of the program.

(Click Here to read total PDF article from the Social Security Administration)

SilverSneakers Fitness Benefits For Retirees

YouTube Video of Planet Fitness (gym) (Your Webhost's SilverSneakers Provider)

HealthWays SilverSneaker Fitness (see link above) is but one Medicare Insurance Provider offering free access to Gyms across the country for eligible seniors. Link provides access to database of gyms offering this Program in your area.

Available for some retirees depending on their Medicare Insurance Provider.

You can choose from more than 13,000 locations.

You can use as many facilities as you like! Work out with cardio and weight equipment, access pools or take group exercise classes taught by instructors trained specifically in senior fitness.

Available for some retirees depending on their Medicare Insurance Provider.

You can choose from more than 13,000 locations.

You can use as many facilities as you like! Work out with cardio and weight equipment, access pools or take group exercise classes taught by instructors trained specifically in senior fitness.

Health and Exercise to Live a Longer Life

YouTube Video: Dance Along Workout for Seniors and Elderly - Low Impact Dance Exercise on Chairs

Pictured: Two forms of exercise for Seniors

Do you want to add years to your life? Or life to your years?

Feeling your best boosts your zeal for life!

The American Heart Association recommends at least 150-minutes of moderate activity each week. An easy way to remember this is 30 minutes at least 5 days a week, but three 10-minute periods of activity are as beneficial to your overall fitness as one 30-minute session. This is achievable! Physical activity may also help encourage you to spend some time outdoors.

Here are some reasons why physical activity is proven to improve both mental and physical health.

Physical activity boosts mental wellness. Regular physical activity can relieve tension, anxiety, depression and anger. You may notice a "feel good sensation" immediately following your physical activity, and most people also note an improvement in general well-being over time as physical activity becomes a part of their routine.

Physical activity improves physical wellness.

Reduced Risk Factors

Too much sitting and other sedentary activities can increase your risk of cardiovascular disease. One study showed that adults who watch more than 4 hours of television a day had a 46% increased risk of death from any cause and an 80% increased risk of death from cardiovascular disease.

Becoming more active can help lower your blood pressure and also boost your levels of good cholesterol.

Physical activity prolongs your optimal health.Without regular physical activity, the body slowly loses its strength, stamina and ability to function well. People who are physically active and at a healthy weight live about 7 years longer than those who are not active and are obese.

(Click Here to See Rest of Article)

Feeling your best boosts your zeal for life!

The American Heart Association recommends at least 150-minutes of moderate activity each week. An easy way to remember this is 30 minutes at least 5 days a week, but three 10-minute periods of activity are as beneficial to your overall fitness as one 30-minute session. This is achievable! Physical activity may also help encourage you to spend some time outdoors.

Here are some reasons why physical activity is proven to improve both mental and physical health.

Physical activity boosts mental wellness. Regular physical activity can relieve tension, anxiety, depression and anger. You may notice a "feel good sensation" immediately following your physical activity, and most people also note an improvement in general well-being over time as physical activity becomes a part of their routine.

Physical activity improves physical wellness.

Reduced Risk Factors

Too much sitting and other sedentary activities can increase your risk of cardiovascular disease. One study showed that adults who watch more than 4 hours of television a day had a 46% increased risk of death from any cause and an 80% increased risk of death from cardiovascular disease.

Becoming more active can help lower your blood pressure and also boost your levels of good cholesterol.

Physical activity prolongs your optimal health.Without regular physical activity, the body slowly loses its strength, stamina and ability to function well. People who are physically active and at a healthy weight live about 7 years longer than those who are not active and are obese.

(Click Here to See Rest of Article)

Public employee pension plans in the United States

YouTube Video: Basics of Pension Funds & other Investing Strategies & Investing Options.

In the United States, public sector pensions are offered by federal, state and local levels of government. They are available to most, but not all, public sector employees.

These employer contributions to these plans typically vest after some period of time. These plans may be defined-benefit or defined-contribution pension plans, but the former have been most widely used by public agencies in the U.S. throughout the late twentieth century. Some local governments do not offer defined-benefit pensions but may offer a defined contribution plan. In many states, public employee pension plans are known as Public Employee Retirement Systems (PERS).

Unlike the private sector, in the public sector once an employee is hired their pension benefit terms cannot be changed. Retirement age in the public sector is usually lower than in the private sector. Public pension plan managers in the United States take higher risks investing the funds than ones outside the United States or those in the private sector.

Federal Employees Retirement System - covers approximately 2.44 million full-time civilian employees (as of Dec 2005

Each of the 50 US states has at least one retirement system for its employees. There are 3.68 million full-time and 1.39 million part-time state-level-government civilian employees as of 2002.

At the local level, Many U.S. cities are allowed to participate in the pension plans of their states; some of the largest have their own pension plans. The total number of local government employees in the United States as of 2002 is 13.2 million. There are 10.15 million full-time and 3.13 million part-time local-government civilian employees as of 2002.

These employer contributions to these plans typically vest after some period of time. These plans may be defined-benefit or defined-contribution pension plans, but the former have been most widely used by public agencies in the U.S. throughout the late twentieth century. Some local governments do not offer defined-benefit pensions but may offer a defined contribution plan. In many states, public employee pension plans are known as Public Employee Retirement Systems (PERS).

Unlike the private sector, in the public sector once an employee is hired their pension benefit terms cannot be changed. Retirement age in the public sector is usually lower than in the private sector. Public pension plan managers in the United States take higher risks investing the funds than ones outside the United States or those in the private sector.

Federal Employees Retirement System - covers approximately 2.44 million full-time civilian employees (as of Dec 2005

Each of the 50 US states has at least one retirement system for its employees. There are 3.68 million full-time and 1.39 million part-time state-level-government civilian employees as of 2002.

At the local level, Many U.S. cities are allowed to participate in the pension plans of their states; some of the largest have their own pension plans. The total number of local government employees in the United States as of 2002 is 13.2 million. There are 10.15 million full-time and 3.13 million part-time local-government civilian employees as of 2002.

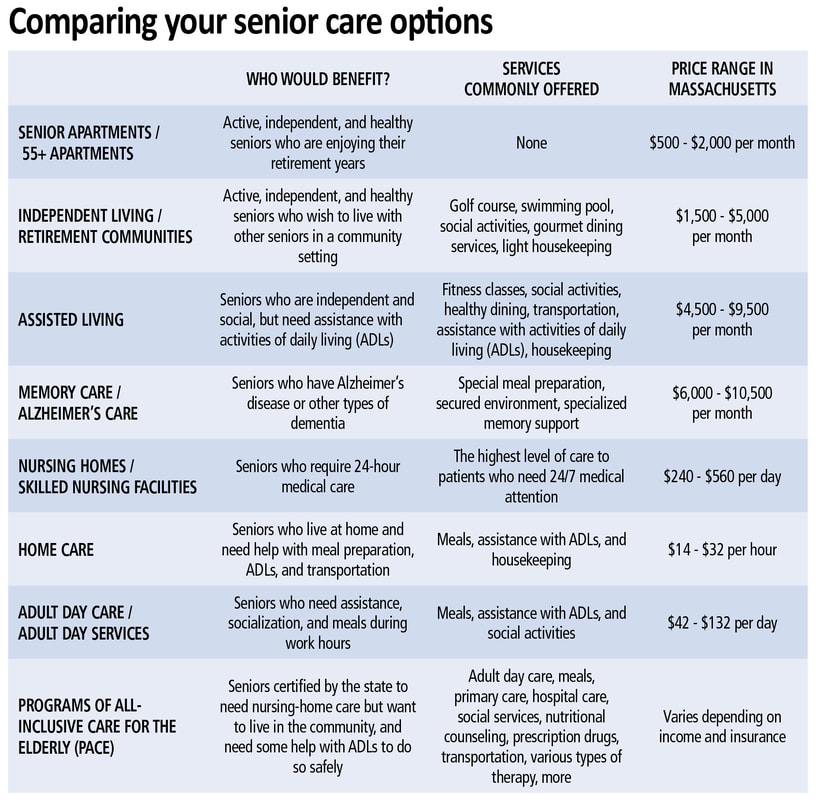

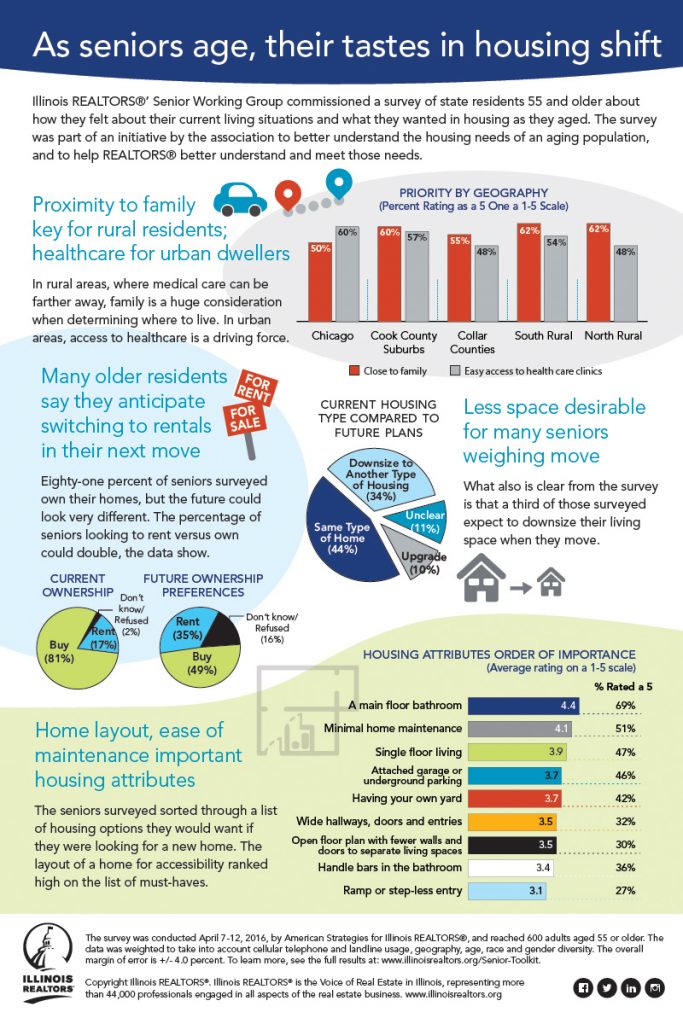

Retirement Communities including Continuing Care Retirement Communities in the United States

YouTube Video of Florida Retirement communities - LAKE ASHTON ACTIVITIES

Pictured: Courtesy of The Hermitage at Cedarfield, a retirement community designed for active older adults aged 62 or better. Located in western Henrico County, a suburban area of Richmond, Virginia.

A retirement community is a housing complex designed for older adults who are generally able to care for themselves; however, assistance from home care agencies is allowed in some communities, and activities and socialization opportunities are often provided.

Some of the characteristics typically are: the community must be age-restricted or age-qualified, residents must be partially or fully retired, and the community offers shared services or amenities.

Additionally, there are different types of retirement communities older adults can choose from including:

New types of retirement communities are being developed as the population ages including elder co-housing, which is defined later in this article. Retirement communities are often built in warm climates, and are common in Arizona, California, Florida and Texas but are increasingly being built in and around major cities throughout the United States.

Youngtown, Arizona, established in 1954, was the first age-restricted community. Del Webb opened Sun City, Arizona, with the active adult concept, in 1960.

In 2011, The Villages, Florida is the largest of these communities.

While new retirement communities have developed in various areas of the United States, they are largely marketed to older adults who are financially secure. Lower income retirement communities are rare except for government subsidized housing, which neglects a large proportion of older adults who have fewer financial resources.

Some of the characteristics typically are: the community must be age-restricted or age-qualified, residents must be partially or fully retired, and the community offers shared services or amenities.

Additionally, there are different types of retirement communities older adults can choose from including:

- Independent living communities, which offer no personal care services.

- Congregate housing, which includes at least one shared meal per day with other residents.

- Mobile homes or RV's for active adults.

- Subsidized housing for lower income older adults.

- Leisure or lifestyle oriented communities or LORCs, which include various amenities.

- Assisted Living Communities: Assisted Living and Memory Care assisted living provide all the daily services seniors need in an apartment or condo style environment. Everything from housekeeping, nursing, dining, wellness,activities, and usually in a locked and secured building.

- Continuing Care Retirement Communities, which are further defined below.

New types of retirement communities are being developed as the population ages including elder co-housing, which is defined later in this article. Retirement communities are often built in warm climates, and are common in Arizona, California, Florida and Texas but are increasingly being built in and around major cities throughout the United States.

Youngtown, Arizona, established in 1954, was the first age-restricted community. Del Webb opened Sun City, Arizona, with the active adult concept, in 1960.

In 2011, The Villages, Florida is the largest of these communities.

While new retirement communities have developed in various areas of the United States, they are largely marketed to older adults who are financially secure. Lower income retirement communities are rare except for government subsidized housing, which neglects a large proportion of older adults who have fewer financial resources.

Retirement Plans in the United States

YouTube Video: How to Plan for Retirement (USA.gov)

A retirement plan is a financial arrangement designed to replace employment income upon retirement. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions.

Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. Federal tax aspects of retirement plans in the United States are based on provisions of the Internal Revenue Code and the plans are regulated by the Department of Labor under the provisions of the Employee Retirement Income Security Act (ERISA).

Retirement plans are classified as either defined benefit plans or defined contribution plans, depending on how benefits are determined.In a defined benefit (or pension) plan, benefits are calculated using a fixed formula that typically factors in final pay and service with an employer, and payments are made from a trust fund specifically dedicated to the plan. Separate accounts for each participant do not exist.

By contrast, in a defined contribution plan, each participant has an account, and the benefit for the participant is dependent upon both the amount of money contributed into the account and the performance of the investments purchased with the funds contributed to the account.

Some types of retirement plans, such as cash balance plans, combine features of both defined benefit and defined contribution schemes.

Click on any of the following blue hyperlinks for further amplification:

- Types of retirement plans

- Contrasting types of retirement plans

- Portability and valuation

- Tax advantages

- History of pensions in the United States

- See also:

- Retirement plan

- Individual retirement account (IRA)

- Public employee pension plans in the United States

- 401(k)

- 403(b) - Similar to the 401(k), but for educational, religious, public healthcare, or non-profit workers

- 401(a) and 457 plans - For employees of state and local governments and certain tax-exempt entities

- Roth IRA - Similar to the IRA, but funded with after-tax dollars, with distributions being tax-free

- Roth 401(k) - Introduced in 2006; a 401(k) plan with the tax features of a Roth IRA

Senior Citizen Retirement Benefits for Veterans

Available from the U.S. Department of Veterans Affairs (VA)

YouTube Video Provided by the VA about VA Programs

From the Above Web Site: Services and other Programs Extended to Senior Veterans

Geriatrics and Extended Care Services (GEC): is committed to optimizing the health and well-being of Veterans with multiple chronic conditions, life-limiting illness, frailty or disability associated with chronic disease, aging or injury.

The Guide is a complete resource for Veterans and their caregivers. We encourage you to try the shared decision making approach – where Veterans involve their caregivers, social workers and health care providers to make decisions and choices about their current and future health needs.

Geriatrics and Extended Care Services (GEC): is committed to optimizing the health and well-being of Veterans with multiple chronic conditions, life-limiting illness, frailty or disability associated with chronic disease, aging or injury.

The Guide is a complete resource for Veterans and their caregivers. We encourage you to try the shared decision making approach – where Veterans involve their caregivers, social workers and health care providers to make decisions and choices about their current and future health needs.

Senior Citizen Housing (Federal Housing of Urban Development -- HUD)

YouTube Video: HUD Offers Housing Assistance Grant for Seniors, Disabled

Looking for Information for Senior Citizens looking for housing options for yourself, an aging parent, relative, or friend?

Do some research first to determine what kind of assistance or living arrangement you need; what your health insurance might cover; and what you can afford. Then check here for financial assistance resources and guides for making the right choice. Talk to a HUD-approved housing counselor if you have questions about your situation.

Stay in Your Home

Find an Apartment

- Units for the Elderly and Persons with Disabilities

- Find affordable rents

- Public housing

- Housing Choice Vouchers (Section 8)

- Rural rental help

Protect Yourself

HUD's mission is to create strong, sustainable, inclusive communities and quality affordable homes for all. HUD is working to strengthen the housing market to bolster the economy and protect consumers; meet the need for quality affordable rental homes; utilize housing as a platform for improving quality of life; build inclusive and sustainable communities free from discrimination, and transform the way HUD does business.

Sporting Activities for Seniors

From HelpGuide.org: "A trusted non-profit guide to mental health and well-being"

YouTube Video: 15 Min Senior Workout - HASfit Exercise for Elderly - Seniors Exercises for Elderly - Seniors

Exercise and Fitness as You Age: Exercise Tips to Get Fit and Stay Fit as You Grow Older

From The Website: "As you grow older, an active lifestyle is more important than ever. Regular exercise can help boost energy, maintain your independence, and manage symptoms of illness or pain. Exercise can even reverse some of the symptoms of aging. And not only is exercise good for your body, it’s also good for your mind, mood, and memory. Whether you are generally healthy or are managing an illness, there are plenty of ways to get more active, improve confidence, and boost your fitness.

Exercise is the key to healthy aging

Starting or maintaining a regular exercise routine can be a challenge as you get older. You may feel discouraged by illness, ongoing health problems, or concerns about injuries or falls. Or, if you've never exercised before, you may not know where to begin. Or perhaps you think you're too old or frail, or that exercise is boring or simply not for you.

While these may seem like good reasons to slow down and take it easy as you age, they're actually even better reasons to get moving. Exercise can energize your mood, relieve stress, help you manage symptoms of illness and pain, and improve your overall sense of well-being. In fact, exercise is the key to staying strong, energetic, and healthy as you get older. And it can even be fun, too, especially if you find like-minded people to exercise with.

No matter your age or your current physical condition, you can benefit from exercise. Reaping the rewards of exercise doesn’t have to involve strenuous workouts or trips to the gym. It’s about adding more movement and activity to your life, even in small ways. Whether you are generally healthy or are managing an illness—even if you’re housebound—there are many easy ways to get your body moving and improve your health and outlook..."

(For Rest of Article, Click Here)

From The Website: "As you grow older, an active lifestyle is more important than ever. Regular exercise can help boost energy, maintain your independence, and manage symptoms of illness or pain. Exercise can even reverse some of the symptoms of aging. And not only is exercise good for your body, it’s also good for your mind, mood, and memory. Whether you are generally healthy or are managing an illness, there are plenty of ways to get more active, improve confidence, and boost your fitness.

Exercise is the key to healthy aging

Starting or maintaining a regular exercise routine can be a challenge as you get older. You may feel discouraged by illness, ongoing health problems, or concerns about injuries or falls. Or, if you've never exercised before, you may not know where to begin. Or perhaps you think you're too old or frail, or that exercise is boring or simply not for you.

While these may seem like good reasons to slow down and take it easy as you age, they're actually even better reasons to get moving. Exercise can energize your mood, relieve stress, help you manage symptoms of illness and pain, and improve your overall sense of well-being. In fact, exercise is the key to staying strong, energetic, and healthy as you get older. And it can even be fun, too, especially if you find like-minded people to exercise with.

No matter your age or your current physical condition, you can benefit from exercise. Reaping the rewards of exercise doesn’t have to involve strenuous workouts or trips to the gym. It’s about adding more movement and activity to your life, even in small ways. Whether you are generally healthy or are managing an illness—even if you’re housebound—there are many easy ways to get your body moving and improve your health and outlook..."

(For Rest of Article, Click Here)

Maximize Your Social Security Benefits

YouTube Video: Social Security Benefits Calculator

Expert answers to your most common Social Security questions by Jane Bryant Quinn, AARP Bulletin, July/August 2015

"Are you wringing all the money you can out of Social Security? Based on my reader mail, I worry that some of you are losing out. Here are quick answers to the questions I get the most.

What can you apply for?

Retirement benefits, based on your own lifetime earnings. Spousal benefits, based on a living spouse's lifetime earnings. Survivor's benefits, payable after a spouse's death.

You can effectively collect only one of these benefits at a time. Social Security automatically gives you the largest check you're entitled to. Children might get benefits, too.

What's the best age to claim?

This varies a lot. In general, your check is always reduced for life if you file for any benefit before what Social Security calls your "normal retirement age." That's 66 for people born from 1943 to 1954 and rises gradually for every birth year through 1959.

For those born in 1960 or later, normal retirement age is 67. There's a fat bonus for collecting your benefits late: Social Security pays you an extra 8 percent for every year past "normal" that you delay your claim, up to age 70.

Can you claim a benefit as a spouse and later switch to benefits based on your own earnings record?

Yes, provided you wait to file for spousal benefits until you reach "normal" (or "full") retirement age. You might collect a spousal benefit check from, say, age 66 to 70, then put in for your personal retirement benefit, which will have grown.

This strategy does not work, however, if you file before you reach your normal retirement age. Early filers receive a benefit amount equal to the spousal benefit or their own retirement benefit, whichever is higher. Never both.

Does it ever pay to collect benefits early?

For many married couples, yes. A wife, for example, might retire early on a reduced benefit.

When her husband reaches normal retirement age, he can file for spousal benefits on her account. When he reaches 70, he can switch to his own, larger retirement account. How well this strategy works will depend on your ages and which of you is the higher earner.

What if you're divorced?

You can claim spousal and survivor's benefits on your ex's earnings record if you were married for at least 10 years and are not currently married. (Exception: You can keep the survivor's benefits if you remarry after you pass 60.) Your ex has to be eligible for Social Security, even if he or she has not yet retired.

What if your spouse dies?

If you've been collecting a spousal benefit, you can step up to the larger survivor's benefit. To get the maximum amount, consider putting off your claim until you reach normal retirement age.

You might make a different choice, however, if you have a substantial Social Security earnings record of your own. You might take the survivor's benefit early, then switch to your own, larger benefit at a later age. Play with the numbers until you get it right.

Helpful resources

Jane Bryant Quinn is a personal finance expert and author of Making the Most of Your Money NOW. She writes regularly for the Bulletin.

"Are you wringing all the money you can out of Social Security? Based on my reader mail, I worry that some of you are losing out. Here are quick answers to the questions I get the most.

What can you apply for?

Retirement benefits, based on your own lifetime earnings. Spousal benefits, based on a living spouse's lifetime earnings. Survivor's benefits, payable after a spouse's death.

You can effectively collect only one of these benefits at a time. Social Security automatically gives you the largest check you're entitled to. Children might get benefits, too.

What's the best age to claim?

This varies a lot. In general, your check is always reduced for life if you file for any benefit before what Social Security calls your "normal retirement age." That's 66 for people born from 1943 to 1954 and rises gradually for every birth year through 1959.

For those born in 1960 or later, normal retirement age is 67. There's a fat bonus for collecting your benefits late: Social Security pays you an extra 8 percent for every year past "normal" that you delay your claim, up to age 70.

Can you claim a benefit as a spouse and later switch to benefits based on your own earnings record?

Yes, provided you wait to file for spousal benefits until you reach "normal" (or "full") retirement age. You might collect a spousal benefit check from, say, age 66 to 70, then put in for your personal retirement benefit, which will have grown.

This strategy does not work, however, if you file before you reach your normal retirement age. Early filers receive a benefit amount equal to the spousal benefit or their own retirement benefit, whichever is higher. Never both.

Does it ever pay to collect benefits early?

For many married couples, yes. A wife, for example, might retire early on a reduced benefit.

When her husband reaches normal retirement age, he can file for spousal benefits on her account. When he reaches 70, he can switch to his own, larger retirement account. How well this strategy works will depend on your ages and which of you is the higher earner.

What if you're divorced?

You can claim spousal and survivor's benefits on your ex's earnings record if you were married for at least 10 years and are not currently married. (Exception: You can keep the survivor's benefits if you remarry after you pass 60.) Your ex has to be eligible for Social Security, even if he or she has not yet retired.

What if your spouse dies?

If you've been collecting a spousal benefit, you can step up to the larger survivor's benefit. To get the maximum amount, consider putting off your claim until you reach normal retirement age.

You might make a different choice, however, if you have a substantial Social Security earnings record of your own. You might take the survivor's benefit early, then switch to your own, larger benefit at a later age. Play with the numbers until you get it right.

Helpful resources

- AARP: Social Security Calculator

- Government: Social Security Administration, ssa.gov, 800-772-1213, or any Social Security office

- Commercial services: SocialSecurityChoices.com, SocialSecuritySolutions.com, and Maximize My Social Security's website.

- New books: Get What's Yours: The Secrets to Maxing Out Your Social Security, by Laurence J. Kotlikoff, Philip Moeller and Paul Solman; Personal Finance for Seniors for Dummies, by Eric Tyson and Bob Carlson; Social Security for Dummies (Second Edition), by Jonathan Peterson

Jane Bryant Quinn is a personal finance expert and author of Making the Most of Your Money NOW. She writes regularly for the Bulletin.

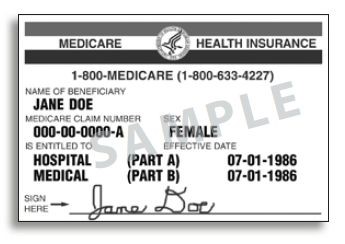

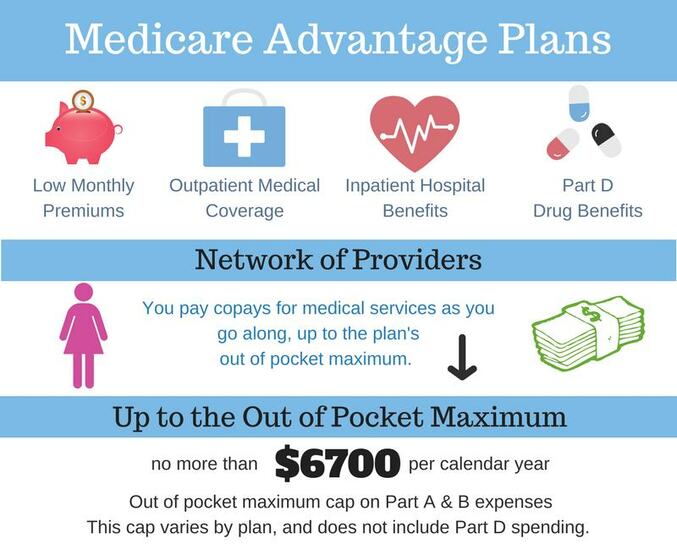

Medicare in the United States including MedigapPictured: A sample Medicare card. There are separate lines for basic Part A and Part B's supplementary medical coverage, each with its own date. There are no lines for Part C or D, which are additional supplemental policies for which a separate card is issued.

In the United States, Medicare is a national social insurance program, administered by the U.S. federal government since 1966, currently using about 30 private insurance companies across the United States.

Medicare provides health insurance for Americans aged 65 and older who have worked and paid into the system. It also provides health insurance to younger people with disabilities, end stage renal disease and amyotrophic lateral sclerosis.

In 2010, Medicare provided health insurance to 48 million Americans—40 million people age 65 and older and eight million younger people with disabilities. It was the primary payer for an estimated 15.3 million inpatient stays in 2011, representing 47.2 percent ($182.7 billion) of total aggregate inpatient hospital costs in the United States.

Medicare serves a large population of elderly and disabled individuals. On average, Medicare covers about half (48 percent) of the health care charges for those enrolled. The enrollees must then cover the remaining approved charges either with supplemental insurance or with another form of out-of-pocket coverage.

Out-of-pocket costs can vary depending on the amount of health care a Medicare enrollee needs. They might include uncovered services—such as long-term, dental, hearing, and vision care—and the supplemental insurance.

The Specialty Society Relative Value Scale Update Committee (or Relative Value Update Committee; RUC), composed of physicians associated with the American Medical Association, advises the government about pay standards for Medicare patient procedures, according to news reports.

Click on any of the following hyperlinks for amplification:

Medigap (also Medicare supplement insurance or Medicare supplemental insurance) refers to various private health insurance plans sold to supplement Medicare in the United States.

Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges.

Medigap's name is derived from the notion that it exists to cover the difference or "gap" between the expenses reimbursed to providers by Medicare Parts A and B for the preceding named services and the total amount allowed to be charged for those services by the United States Centers for Medicare and Medicaid Services (CMS).

As of 2006, 18% of Medicare beneficiaries were covered by a Medigap policy. Public-option Part C Medicare Advantage health plans and private employee retiree insurance provides a similar supplemental role for almost all other Medicare beneficiaries not dual eligible for Medicaid.

Medicare eligibility starts for most Americans when they turn 65 years old. Those who have been on Social Security eligibility for 24 months can also qualify for Medicare Part A and Part B. A person must be enrolled in part A and B of Medicare before they can enroll in a Medigap plan.

When a person turns 65—or if they are older and new to Medicare Part B—they become eligible for Medigap open enrollment. This period starts on the first day of the month you turn 65 and lasts for 6 months. During this period, a person can buy any Medigap plan regardless of their health.

This is different than if someone is losing group coverage or retiring. When this occurs, the person is eligible to exercise his or her "Guarantee Issue" right. With a Medigap guarantee issue right, a person can buy a Medigap Plan A, B, C, F, K, or L that's sold by any insurance company in their state.

In addition, the insurance company cannot deny or raise the premium due to past or current health conditions. Also, the insurance company must cover any pre-existing conditions.

Instead of exercising the guarantee issue right, a person can opt to go through the underwriting process in order to buy a plan G or N. Once a person is outside their open enrollment period and or guarantee issue, they can change their Medigap plan, but they will be subject to health underwriting by the insurance company they are applying with.

It is also important to know that monthly premiums apply, and plans may not be cancelled by the insurer for any reason other than non-payment of premiums/membership dues.

Furthermore, a single Medigap plan may cover only one person. Finally, Medigap insurance is not compatible with a Medicare Advantage plan. You cannot have both a Medicare supplement and a Medicare Advantage plan at the same time. You can only have a Medigap plan if you are still on Medicare Part A and Part B and have not replaced your coverage with a Medicare Advantage Part C coverage.

Medicare recipients under age 65:

Recipients of Social Security Disability Insurance (SSDI) benefits or patients with end-stage renal disease (ESRD) are entitled to Medicare coverage regardless of age, but are not automatically entitled to purchase Medigap policies unless they are at least 65.

Under federal law, insurers are not required to sell Medigap policies to people under 65, and even if they do, they may use medical screening. However, a slight majority of states require insurers to offer at least one kind of Medigap policy to at least some Medicare recipients in that age group.

Of these states, 25 require that Medigap policies be offered to all Medicare recipients. In California, Massachusetts, and Vermont, Medigap policies are not available to end-stage ESRD patients. Part D deductible will go up for about 20% of Americans to over $150.00 a year. That's close to a 50% increase in 2016.

Products Available:

Medigap offerings have been standardized by the Centers for Medicare and Medicaid Services (CMS) into ten different plans, labeled A through N, sold and administered by private companies.

Each Medigap plan offers a different combination of benefits. The coverage provided is roughly proportional to the premium paid. However, many older Medigap plans (these 'older' plans are no longer marketed) offering minimal benefits will cost more than current plans offering full benefits. The reason behind this is that older plans have an older average age per person enrolled in the plan, causing more claims within the group and raising the premium for all members within the group.

Since Medigap is private insurance and not government sponsored, the rules governing the sale and offerings of a Medigap insurance policy can vary from state to state. Some states such as Massachusetts, Minnesota, and Wisconsin require Medigap insurance to provide additional coverage than what is defined in the standardized Medigap plans.

Some employers may provide Medigap coverage as a benefit to their retirees. While Medigap offerings have been standardized since 1992, some seniors who had Medigap plans prior to 1992 are still on non-standard plans. Those plans are no longer eligible for new policies.

Over the years, new laws have brought many changes to Medigap Policies. For example, marketing for plans E, H, I, and J has been stopped as of May 31, 2010. But, if you were already covered by plan E, H, I, or J before June 1, 2010, you can keep that plan. Medigap plans M and N took effect on June 1, 2010, bringing the number of offered plans down to ten from twelve.

Congress passed the bill H.R. 2 on April 14, 2015, which will eliminate plans that cover the part B deductible for new Medicare beneficiaries starting Jan. 1st, 2020. Those who enroll in to Medicare after Jan. 1st, 2020 will not be able to purchase plans F or C; however, those people who enrolled onto Medicare prior to Jan. 1st, 2020 will still be able to purchase plans F or C. Congress believes eliminating first dollar coverage plans will save Medicare money.

Drug Coverage:

Some Medigap policies sold before January 1, 2006 may include prescription drug coverage, but after that date, no new Medigap policies could be sold with drug coverage. This time frame coincides with the introduction of the Medicare Part D benefit.

Medicare beneficiaries who enroll in a Standalone Part D plan may not retain the drug coverage portion of their Medigap policy. People with Medigap policies that include drug coverage who enrolled in Medicare Part D by May 15, 2006 had a guaranteed right to switch to another Medigap policy that has no prescription drug coverage.

Beneficiaries choosing to retain a Medigap policy with drug coverage after that date have no such right; in that case, the opportunity to switch to a Medigap policy without drug coverage is solely at the discretion of the private insurance company issuing the replacement policy, but the beneficiary may choose to remove drug coverage from their current Medigap policy and retain all other benefits.

The vast majority of Medicare beneficiaries who hold a Medigap policy with drug coverage and then enroll in a Part D Plan after May 15, 2006 will have to pay a late enrollment penalty. The only exception is for the few beneficiaries holding a Medigap policy with a drug benefit that is considered "creditable coverage" (i.e. that it meets four criteria defined by the Centers for Medicare and Medicaid Services); a Medigap policy with prescription drug coverage bought before mid-1992 may pay out as much as or more than a Medicare Part D plan.

Medigap policies sold in Massachusetts, Minnesota, and Wisconsin with prescription coverage may also pay out as much as or more than Part D.

Thus, individuals who qualify for the Qualified Medicare Beneficiary (QMB) program generally also do not need, and should not pay for, Medicare Supplement Insurance. Some employers offer health insurance coverage to their retirees. Retirees who are covered by such group plans may not need to purchase an individual policy.

While a retiree may choose to switch to an individual plan, this may not be a good choice because group retiree plans usually do not cost anything to the individual and the group coverage is often as good or better than most individual Medigap policies. Thus, the individual should compare his company's policy costs and coverage with the ten Medigap policies.

The retiree should also consider the stability of his company. If it is conceivable that the company will falter, that his costs will rise, or that coverage will diminish, the individual may wish to purchase an independent policy. Remember, however, that if a new policy is purchased, the old policy must be dropped. More information at:

Enrollment Patterns:

In 2006, 18% of Medicare beneficiaries were covered by Original Medicare (Part A and B) supplemented with a standardized Medigap Plan, while another 65% had other coverage through employer-based policies, Medicare Advantage policies, or Medicaid or other public insurance.

Almost a third of Medigap policyholders (31%) live in rural areas; in comparison, roughly a fourth of all Medicare beneficiaries live in rural areas. Two-thirds of rural Medigap policyholders (66%) report incomes below $30,000.

See Also:

Medicare provides health insurance for Americans aged 65 and older who have worked and paid into the system. It also provides health insurance to younger people with disabilities, end stage renal disease and amyotrophic lateral sclerosis.

In 2010, Medicare provided health insurance to 48 million Americans—40 million people age 65 and older and eight million younger people with disabilities. It was the primary payer for an estimated 15.3 million inpatient stays in 2011, representing 47.2 percent ($182.7 billion) of total aggregate inpatient hospital costs in the United States.

Medicare serves a large population of elderly and disabled individuals. On average, Medicare covers about half (48 percent) of the health care charges for those enrolled. The enrollees must then cover the remaining approved charges either with supplemental insurance or with another form of out-of-pocket coverage.

Out-of-pocket costs can vary depending on the amount of health care a Medicare enrollee needs. They might include uncovered services—such as long-term, dental, hearing, and vision care—and the supplemental insurance.

The Specialty Society Relative Value Scale Update Committee (or Relative Value Update Committee; RUC), composed of physicians associated with the American Medical Association, advises the government about pay standards for Medicare patient procedures, according to news reports.

Click on any of the following hyperlinks for amplification:

- Program history

- Administration

- Financing

- Eligibility

- Benefits

- Out-of-pocket costs

- Payment for services

- Comparison with private insurance

- Costs and funding challenges

- Criticism

- Legislation and reform

- Legislative oversight

- See also:

- Administration on Aging

- Federal Insurance Contributions Act

- Health care in the United States

- Health care politics

- Health care reform in the United States

- Health insurance in the United States

- Medicaid

- Medicare Rights Center

- Patient Protection and Affordable Care Act (Obamacare)

- Philosophy of healthcare

- Quality improvement organizations

- Single-payer health care

- Stark Law

- United States National Health Care Act (Expanded and Improved Medicare for All Act)

- External links

Medigap (also Medicare supplement insurance or Medicare supplemental insurance) refers to various private health insurance plans sold to supplement Medicare in the United States.

Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges.

Medigap's name is derived from the notion that it exists to cover the difference or "gap" between the expenses reimbursed to providers by Medicare Parts A and B for the preceding named services and the total amount allowed to be charged for those services by the United States Centers for Medicare and Medicaid Services (CMS).

As of 2006, 18% of Medicare beneficiaries were covered by a Medigap policy. Public-option Part C Medicare Advantage health plans and private employee retiree insurance provides a similar supplemental role for almost all other Medicare beneficiaries not dual eligible for Medicaid.

Medicare eligibility starts for most Americans when they turn 65 years old. Those who have been on Social Security eligibility for 24 months can also qualify for Medicare Part A and Part B. A person must be enrolled in part A and B of Medicare before they can enroll in a Medigap plan.

When a person turns 65—or if they are older and new to Medicare Part B—they become eligible for Medigap open enrollment. This period starts on the first day of the month you turn 65 and lasts for 6 months. During this period, a person can buy any Medigap plan regardless of their health.

This is different than if someone is losing group coverage or retiring. When this occurs, the person is eligible to exercise his or her "Guarantee Issue" right. With a Medigap guarantee issue right, a person can buy a Medigap Plan A, B, C, F, K, or L that's sold by any insurance company in their state.

In addition, the insurance company cannot deny or raise the premium due to past or current health conditions. Also, the insurance company must cover any pre-existing conditions.

Instead of exercising the guarantee issue right, a person can opt to go through the underwriting process in order to buy a plan G or N. Once a person is outside their open enrollment period and or guarantee issue, they can change their Medigap plan, but they will be subject to health underwriting by the insurance company they are applying with.

It is also important to know that monthly premiums apply, and plans may not be cancelled by the insurer for any reason other than non-payment of premiums/membership dues.

Furthermore, a single Medigap plan may cover only one person. Finally, Medigap insurance is not compatible with a Medicare Advantage plan. You cannot have both a Medicare supplement and a Medicare Advantage plan at the same time. You can only have a Medigap plan if you are still on Medicare Part A and Part B and have not replaced your coverage with a Medicare Advantage Part C coverage.

Medicare recipients under age 65:

Recipients of Social Security Disability Insurance (SSDI) benefits or patients with end-stage renal disease (ESRD) are entitled to Medicare coverage regardless of age, but are not automatically entitled to purchase Medigap policies unless they are at least 65.

Under federal law, insurers are not required to sell Medigap policies to people under 65, and even if they do, they may use medical screening. However, a slight majority of states require insurers to offer at least one kind of Medigap policy to at least some Medicare recipients in that age group.

Of these states, 25 require that Medigap policies be offered to all Medicare recipients. In California, Massachusetts, and Vermont, Medigap policies are not available to end-stage ESRD patients. Part D deductible will go up for about 20% of Americans to over $150.00 a year. That's close to a 50% increase in 2016.

Products Available:

Medigap offerings have been standardized by the Centers for Medicare and Medicaid Services (CMS) into ten different plans, labeled A through N, sold and administered by private companies.

Each Medigap plan offers a different combination of benefits. The coverage provided is roughly proportional to the premium paid. However, many older Medigap plans (these 'older' plans are no longer marketed) offering minimal benefits will cost more than current plans offering full benefits. The reason behind this is that older plans have an older average age per person enrolled in the plan, causing more claims within the group and raising the premium for all members within the group.

Since Medigap is private insurance and not government sponsored, the rules governing the sale and offerings of a Medigap insurance policy can vary from state to state. Some states such as Massachusetts, Minnesota, and Wisconsin require Medigap insurance to provide additional coverage than what is defined in the standardized Medigap plans.

Some employers may provide Medigap coverage as a benefit to their retirees. While Medigap offerings have been standardized since 1992, some seniors who had Medigap plans prior to 1992 are still on non-standard plans. Those plans are no longer eligible for new policies.

Over the years, new laws have brought many changes to Medigap Policies. For example, marketing for plans E, H, I, and J has been stopped as of May 31, 2010. But, if you were already covered by plan E, H, I, or J before June 1, 2010, you can keep that plan. Medigap plans M and N took effect on June 1, 2010, bringing the number of offered plans down to ten from twelve.

Congress passed the bill H.R. 2 on April 14, 2015, which will eliminate plans that cover the part B deductible for new Medicare beneficiaries starting Jan. 1st, 2020. Those who enroll in to Medicare after Jan. 1st, 2020 will not be able to purchase plans F or C; however, those people who enrolled onto Medicare prior to Jan. 1st, 2020 will still be able to purchase plans F or C. Congress believes eliminating first dollar coverage plans will save Medicare money.

Drug Coverage:

Some Medigap policies sold before January 1, 2006 may include prescription drug coverage, but after that date, no new Medigap policies could be sold with drug coverage. This time frame coincides with the introduction of the Medicare Part D benefit.

Medicare beneficiaries who enroll in a Standalone Part D plan may not retain the drug coverage portion of their Medigap policy. People with Medigap policies that include drug coverage who enrolled in Medicare Part D by May 15, 2006 had a guaranteed right to switch to another Medigap policy that has no prescription drug coverage.

Beneficiaries choosing to retain a Medigap policy with drug coverage after that date have no such right; in that case, the opportunity to switch to a Medigap policy without drug coverage is solely at the discretion of the private insurance company issuing the replacement policy, but the beneficiary may choose to remove drug coverage from their current Medigap policy and retain all other benefits.

The vast majority of Medicare beneficiaries who hold a Medigap policy with drug coverage and then enroll in a Part D Plan after May 15, 2006 will have to pay a late enrollment penalty. The only exception is for the few beneficiaries holding a Medigap policy with a drug benefit that is considered "creditable coverage" (i.e. that it meets four criteria defined by the Centers for Medicare and Medicaid Services); a Medigap policy with prescription drug coverage bought before mid-1992 may pay out as much as or more than a Medicare Part D plan.

Medigap policies sold in Massachusetts, Minnesota, and Wisconsin with prescription coverage may also pay out as much as or more than Part D.

Thus, individuals who qualify for the Qualified Medicare Beneficiary (QMB) program generally also do not need, and should not pay for, Medicare Supplement Insurance. Some employers offer health insurance coverage to their retirees. Retirees who are covered by such group plans may not need to purchase an individual policy.

While a retiree may choose to switch to an individual plan, this may not be a good choice because group retiree plans usually do not cost anything to the individual and the group coverage is often as good or better than most individual Medigap policies. Thus, the individual should compare his company's policy costs and coverage with the ten Medigap policies.

The retiree should also consider the stability of his company. If it is conceivable that the company will falter, that his costs will rise, or that coverage will diminish, the individual may wish to purchase an independent policy. Remember, however, that if a new policy is purchased, the old policy must be dropped. More information at:

Enrollment Patterns:

In 2006, 18% of Medicare beneficiaries were covered by Original Medicare (Part A and B) supplemented with a standardized Medigap Plan, while another 65% had other coverage through employer-based policies, Medicare Advantage policies, or Medicaid or other public insurance.

Almost a third of Medigap policyholders (31%) live in rural areas; in comparison, roughly a fourth of all Medicare beneficiaries live in rural areas. Two-thirds of rural Medigap policyholders (66%) report incomes below $30,000.

See Also:

- Health insurance in the United States

- Medicare Supplement Overview at Medicare.gov

- Benefits Grid for the different Medigap plans at Medicare.gov

Retirees as Snowbirds

YouTube Video: Crazy Horse Campground and RV Park in Tucson, Arizona

Pictured: Retirees as Snowbirds migrating to Florida for the Winter as LEFT: “Snowbird” License Plate; RIGHT: Snowbird’s beachfront trailer courtesy Beachfront RV Park

A snowbird is a term often associated with people who move from the higher latitudes and colder climates of the northern United States and Canada and migrate southward in winter to warmer locales such as Florida, California, Hawaii, Arizona, Texas, or elsewhere along the Sun Belt of the southern and southwestern United States, Mexico, and areas of the Caribbean.

Snowbirds are typically retirees who wish to avoid the snow and cold temperatures of northern winter, but maintain ties with family and friends by staying there the rest of the year.

Some snowbirds bring their homes with them, as campers (mounted on bus or truck frames) or as boats following the East Coast Intracoastal waterway.

A significant portion of the snowbird community is made up of recreational vehicle users (RVers). Many own a motorhome for the sole purpose of traveling south in the winter. Often they go to the same location every year and consider the other RVers that do the same a "second family".

Many RV parks label themselves "snowbird friendly" and get the majority of their income from the influx of RVing snowbirds. There are places like Quartzsite, Arizona, that have been labeled "white cities" because from a bird's-eye view all the motorhomes cover the landscape in white and then in the summer are gone.

While historically Florida has been the number one RV snowbird location, other southern U.S. states are experiencing a boom from snowbirds enjoying the southern climate for example.

In the United States, the right to vote for local office is governed by local and state law, so it may be possible to vote for local offices in both places if the locality permits nonresident voting based on property ownership.

However, representation in the United States Congress is for residents as enumerated by the decennial census and voting in U.S. federal elections in more than one jurisdiction is deemed to be electoral fraud.

See also:

Snowbirds are typically retirees who wish to avoid the snow and cold temperatures of northern winter, but maintain ties with family and friends by staying there the rest of the year.

Some snowbirds bring their homes with them, as campers (mounted on bus or truck frames) or as boats following the East Coast Intracoastal waterway.

A significant portion of the snowbird community is made up of recreational vehicle users (RVers). Many own a motorhome for the sole purpose of traveling south in the winter. Often they go to the same location every year and consider the other RVers that do the same a "second family".

Many RV parks label themselves "snowbird friendly" and get the majority of their income from the influx of RVing snowbirds. There are places like Quartzsite, Arizona, that have been labeled "white cities" because from a bird's-eye view all the motorhomes cover the landscape in white and then in the summer are gone.

While historically Florida has been the number one RV snowbird location, other southern U.S. states are experiencing a boom from snowbirds enjoying the southern climate for example.

In the United States, the right to vote for local office is governed by local and state law, so it may be possible to vote for local offices in both places if the locality permits nonresident voting based on property ownership.

However, representation in the United States Congress is for residents as enumerated by the decennial census and voting in U.S. federal elections in more than one jurisdiction is deemed to be electoral fraud.

See also:

- Canadian Snowbird Association

- Canadians of convenience

- Coachella Valley – a major destination in the desert of California for snowbirds and part-time residents from Canada and the Pacific Northwest

- RV lifestyle

- Seasonal human migration

What to Expect in Your 70s and Beyond by AARP Magazine October 10, 2012.

YouTube Video: Age Strongly: Exercises for Ages 70+

Pictured below: (L) Studies show strength training can build muscle, which can take force off the joints.; (R) 44 percent of women 68 through 80 report being very satisfied with their sex lives, compared with just 30 percent of women 55 to 68 years old.

Staying mentally and physically active can help keep you, well, young. What can you expect of the years ahead?

Everyone ages differently, and lifestyle plays a major role, but you'll experience both hard-to-notice and impossible-to-miss changes in your physical and mental health.

Read on for the good, the bad and the what's-up-with-that? transformations you'll encounter — plus the latest advice on feeling happy, sexy and pain-free.

Save Your Skin

The Good News: Your skin is drier, which can be welcome relief for the third of women who were plagued by oily skin and breakouts throughout their adulthood.

The Not-So-Good News: Wrinkles and lines are more plentiful, but so are the options for keeping skin looking bright. Gentle exfoliation and moisturizing are especially important.

Pick skin products with antioxidants and glycolic acid, which promote skin thickening and increase collagen production. And apply a broad-spectrum sunscreen with a sun protection factor (SPF) of at least 30 every day.

Laser treatments can help with dilated superficial blood vessels (called telangiectasias), which tend to appear without warning on the cheeks, nose, chin and legs. (The laser destroys the blood vessels underneath the skin - with no scarring.) And those extra skin tags? Your doctor can remove them through freezing, snipping or cauterizing.

What's Up With That? Non-articular cartilage, the type that gives ears and noses their shape, continues to grow with age, making these appendages larger. But look on the bright side: Such cartilage growth may have evolved to enable people to track and funnel sounds and smells as they age, suggests James Stankiewicz, M.D., chair of the Department of Otolaryngology — Head and Neck Surgery at Loyola University Chicago Stritch School of Medicine.

What's Ahead: As you age, the skin around your jawline tends to sag. If you're bothered by it, ask your doctor about skin-tightening radio-frequency treatments, which can tighten skin without damaging the epidermis.

Bone Up for Good Health:

The Good News: You can maintain muscle strength through activity.

The Not-So-Good News: About one in three women ages 75 through 85 has osteoporosis, a bone-thinning disease, which greatly increases the risk of fractures of the hip and spine. Studies show strength training can build muscle, which can take force off the joints. Plus, weight-bearing activities stimulate the bones to grow stronger and denser.

What's Up With That? Although worn joints may benefit from anti-inflammatory drugs and activity, surgery may become necessary as cartilage loss begins to accelerate. Regenerative techniques such as platelet-rich plasma and autologous (self) stem cell injections may also help, according to Nathan Wei, M.D., a rheumatologist in Frederick, Md.

What's Ahead: Joint-replacement surgeries are common; one study showed that patients 75-plus recover just as quickly as those 65 to 74.

Preserve Your Senses:

The Good News: Lifestyle plays a major role in helping to maintain your senses as you age. So stay away from loud noises, eat a well-balanced diet (which can help ward off such age-related eye disorders as macular degeneration) and see a doctor immediately if you notice that your senses of smell or taste diminish significantly. (This may indicate a sinus infection or be a reaction to medication.)

The Not-So-Good News: You may have trouble seeing when first entering a very dark or bright area. That's because as you age, your eye muscles slow down, causing your eyes' pupils to react more slowly to changes in light. After age 70, the ability to see fine details diminishes as well, because there are fewer nerve cells to transmit visual signals to the brain.

If you're plagued by dry eye, medications like Restasis can help create more tears.

Finally, some 68 percent of 70-somethings experience some degree of hearing loss. What to do? Swallow your pride and get tested for hearing aids, which have been associated with less cognitive decline and dementia. Wearing the devices could pay off in the long run, experts say, by helping you stay engaged with others and your environment.

What's Up With That? Have you noticed that blues seem gray and reds appear more intense? Not to worry. It's just changes in the lenses in your eyes, which have started to yellow with age. If it gets too bad, you may need cataract surgery. About half of people ages 65 through 74 have cataracts; the number rises to more than 70 percent among those 75 or older.

What's Ahead: Your senses of smell and taste have likely declined, reducing the ability to enjoy subtle flavors. Taste buds decrease in number and sensitivity, and nerve endings in the nose may not work as well. The fix? Turn up the dial on seasonings. Ethnic cuisines like Indian and Thai contain spices and herbs that amplify the aromas and tastes of foods.

Improve Your Sex Life:

The Good News: Sex in your 70s and beyond? You bet! A recent survey found that 70-year-old men and women were much more likely to be sexually active, to report being in a happy relationship and to have a positive attitude toward sex than people that age who were polled in the 1970s and 1990s. Some 44 percent of women 68 through 80 report being very satisfied with their sex lives, compared with just 30 percent of women 55 to 68 years old.

The Not-So-Good News: Sex-related hormones — estrogen and progesterone in women, testosterone in men — decline, and vaginal dryness may become more noticeable. But lubricants are effective, as are prescription creams and tablets.

What's Up With That? Rates of erectile dysfunction (ED) increase with age; by 70, between 40 and 60 percent of men will experience symptoms. Research shows that not smoking and eating a diet rich in antioxidants can help.

What's Ahead: A University of Chicago study finds almost 40 percent of men 75 to 85 are sexually active.

Motivate Your Metabolism:

The Good News: While metabolism typically slows up to 5 percent per decade, that doesn't mean you have to gain weight in your 70s. Just stay active and cut calories if needed, says Alice Lichtenstein, D.Sc., director of the Cardiovascular Nutrition Laboratory at the USDA Human Nutrition Research Center on Aging.

The Not-So-Good News: In your 70s you may secrete less hydrochloric acid, which decreases the availability of vitamin B12, says Lichtenstein. Ask your doctor if you need a B12 supplement (optimal dose: 2.4 mcg daily).

What's Up With That? As you age, your ability to produce vitamin D in response to sunlight gradually decreases. Your doctor may recommend a vitamin D supplement — after age 70, you need 800 IU of vitamin D every day, as well as 1,200 mg daily of calcium.

What's Ahead: The sensations of hunger and thirst can decrease with age, often leading to dehydration and malnutrition. Plan to eat several small meals throughout the day, and consume at least 6 cups of liquid.

Ramp Up Your Immunity:

The Good News: Allergies, which result from an overreactive immune system, are likely a thing of the past, because your immune system isn't as sensitive.

The Not-So-Good News: That less-aggressive immune response means you're more susceptible to getting sick. Chronic inflammation, which is linked to heart disease, diabetes and arthritis, makes it even harder for the body to mount an effective immune response. So it's important to shed excess pounds, eat a good diet and exercise.

What's Up With That? Your response to vaccines decreases with age, leaving you even more vulnerable to illnesses like flu and pneumonia. After 65 you're eligible to get a higher-dose flu vaccine. A new study also suggests you can boost the effectiveness of your vaccines by getting at least seven hours of sleep a night.

What's Ahead: Rates of cancer rise with age but then level off around 85, so if you've gotten that far cancer-free, you may reach a very old age.

Keep Your Heart Strong:

The Good News: Older hearts pump about the same volume of blood with each beat as younger hearts.

The Not-So-Good News: Your heart's walls are getting thicker and its valves are stiffer. One way to improve your heart health? Keep moving. Research recently showed that women and men age 70-plus who spent as little as a half hour a day on activities like walking and dancing had a 20 to 40 percent lower risk of dying from heart disease than those who reported no activity.

What's Up With That? A skipped beat or a racing heart could be atrial fibrillation, a type of heart arrhythmia that becomes more common with age. Since it can increase the risk of stroke, mention it to your doctor. You should also say if you're experiencing unusual fatigue, weakness when exercising or dizziness.

What's Ahead: Heart disease incidence rises; it's the leading cause of death for people 75 through 84.

Take Fewer Nighttime Trips:

The Good News: If you're generally healthy, your urological system likely functions pretty well. And an array of therapies can help when problems crop up.

The Not-So-Good News: Bladder tissue contracts and expands less efficiently as you get older, often leading to overactive bladder, incontinence and infection. About 60 percent of women in their 70s will experience some type of urinary incontinence. Ask your doctor about bladder training, medications and pelvic floor exercises ("Kegels"), which can strengthen the muscles around the bladder. More than half of men in their 70s experience symptoms of an enlarged prostate gland, called benign prostatic hyperplasia (BPH). Symptoms include a weak urine flow or difficulty urinating, but medications like tamsulosin and finasteride can help.

What's Up With That? Gotta go during the night? Not to worry; that's normal. "In their 60s, 80 percent of people need to get up at least once a night," says Ryan P. Terlecki, M.D., assistant professor of urology at Wake Forest University School of Medicine in Winston-Salem, North Carolina. And 25 to 35 percent of those in their 70s get up at least twice. Try decreasing fluids after 6 p.m. and avoiding caffeine in the afternoon. If you're on diuretics for high blood pressure, speak to your doctor about taking your pill in the morning.

What's Ahead: Urinary tract infections are common as you age. The counterintuitive advice? If you're not experiencing symptoms, sometimes it's better to do nothing. Antibiotics can clear up the infection, but they often disrupt other bacterial balances.

Be Happy:

The Good News: We're pretty happy. A recent AARP survey showed that of all the decades surveyed, the 70s tend to be some of the happiest years of your life. One explanation for the trend: years of experience. "As you get older, you know that bad times are going to pass," says Laura Carstensen, Ph.D., director of the Stanford Center on Longevity. "You also know that good times will pass, which makes those good times even more precious."

The Not-So-Good News: You might stay away from stressful situations, thereby missing out on new opportunities. Just make sure all of your social interactions stay strong. They may be key to facing future challenges with resilience.

What's Up With That? Does your spouse seem mellower than he or she once did? "The ability to regulate one's emotions improves as you get older," says Bob Knight, Ph.D., professor of gerontology and psychology at the USC Davis School of Gerontology in Los Angeles.

What's Ahead: As long as your health remains good, you can expect to be happy. Studies also suggest that negative emotions like anger and sadness become less frequent with age, perhaps because older adults get better at tuning out negativity.

Stay Sharp:

The Good News: Research shows that the steep loss of brain function once thought intrinsic to aging is often avoidable. "You can improve your brain health by getting regular mental stimulation, social interaction and physical activity," says Gary J. Kennedy, M.D., professor of psychiatry and behavioral science in the Division of Geriatric Psychiatry at Montefiore Medical Center in the Bronx, New York. And your gut instincts remain sharp as you age, too. In one study, older adults fared as well as those under 30 on intuitive decisions.

The Not-So-Good News: Part of your brain circuitry starts to burn out with age, but most of us compensate by relying on other parts of our brain, and our past experiences, to make decisions. "That's the 'wisdom' that accrues with older age," says Kennedy.

What's Up With That? Feeling increasingly forgetful? This happens because the transmission of nerve impulses between cells slows down as you age.

What's Ahead: Real cognitive decline becomes more prevalent by your 80s; nearly half of Americans 85 or older have Alzheimer's. Your best prevention plan, as Kennedy advises: intellectual stimulation, time with family and friends, and exercise.

[End of Article]

Everyone ages differently, and lifestyle plays a major role, but you'll experience both hard-to-notice and impossible-to-miss changes in your physical and mental health.

Read on for the good, the bad and the what's-up-with-that? transformations you'll encounter — plus the latest advice on feeling happy, sexy and pain-free.

Save Your Skin

The Good News: Your skin is drier, which can be welcome relief for the third of women who were plagued by oily skin and breakouts throughout their adulthood.

The Not-So-Good News: Wrinkles and lines are more plentiful, but so are the options for keeping skin looking bright. Gentle exfoliation and moisturizing are especially important.

Pick skin products with antioxidants and glycolic acid, which promote skin thickening and increase collagen production. And apply a broad-spectrum sunscreen with a sun protection factor (SPF) of at least 30 every day.

Laser treatments can help with dilated superficial blood vessels (called telangiectasias), which tend to appear without warning on the cheeks, nose, chin and legs. (The laser destroys the blood vessels underneath the skin - with no scarring.) And those extra skin tags? Your doctor can remove them through freezing, snipping or cauterizing.

What's Up With That? Non-articular cartilage, the type that gives ears and noses their shape, continues to grow with age, making these appendages larger. But look on the bright side: Such cartilage growth may have evolved to enable people to track and funnel sounds and smells as they age, suggests James Stankiewicz, M.D., chair of the Department of Otolaryngology — Head and Neck Surgery at Loyola University Chicago Stritch School of Medicine.

What's Ahead: As you age, the skin around your jawline tends to sag. If you're bothered by it, ask your doctor about skin-tightening radio-frequency treatments, which can tighten skin without damaging the epidermis.

Bone Up for Good Health:

The Good News: You can maintain muscle strength through activity.

The Not-So-Good News: About one in three women ages 75 through 85 has osteoporosis, a bone-thinning disease, which greatly increases the risk of fractures of the hip and spine. Studies show strength training can build muscle, which can take force off the joints. Plus, weight-bearing activities stimulate the bones to grow stronger and denser.

What's Up With That? Although worn joints may benefit from anti-inflammatory drugs and activity, surgery may become necessary as cartilage loss begins to accelerate. Regenerative techniques such as platelet-rich plasma and autologous (self) stem cell injections may also help, according to Nathan Wei, M.D., a rheumatologist in Frederick, Md.